- Publications:

- Newsletter:

- How-To Tutorials:

- Consumer Guides:

- Related:

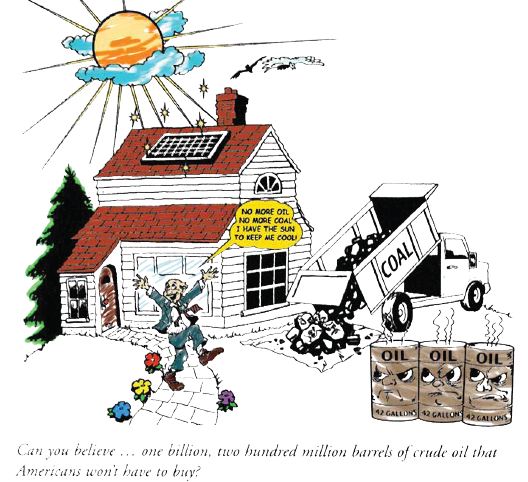

Image by Robert Ubell

Publishers:

Accurate Building Inspectors ©

Division of Ubell Enterprises, Inc.

1860 Bath Avenue

Brooklyn, NY 11214-4616

voice – 718.265.8191

toll free voice – 800.640.8285

fax – 718.449.7190

Lawrence J. Ubell *

- President

Alvin Ubell **

- Founder, Vice President

Matthew Barnett *

- Senior Inspector

Estelle R. Ubell

- Sec. Treasurer

Jennifer S. Bleyer

- Editor-in-Chief

Contributors:

Adam Leitman Bailey, Esq.

Hon. Jules L. Sprodek, (RET)

Robert H. Wolff, Esq. of Rosenberg,

Minc, Falkoff

& Wolff, LLP

Ari Saltz, of GFI Mortgage Bankers, Inc.

Stanley Turkel, MHS, ISHC

Bertrum Herman, Esq.

Howard Kurtzberg, Esq.

Mitchell D. Kessler, Esq.

Sebastian M. D'Alessandro, RA

Terrence E. O'Neal, RA, AIA

David A. Kaminshy, Esq.

John Gallagher, RA AIA

Jeffery A. Sunshine, Esq.

* Licensed in: New York - New Jersey

** Licensed in: NJ

Contribute:

If there is a subject that you would like to see discussed or an article that you would like to contribute to be featured

in The Gotham City Inspector©, please forward your comments to:

Letters to the Editor

Media Notice: The publishers, grant reprint permission of all articles in the Gotham City Inspector© Newsletter, provided that appropriate written recognition is given to the authors and “The Gotham City Inspector©”. For online reprints, please also include an HTML link to The Gotham City Inspector© : www.accuratebuilding.com

The Gotham City Inspector©

Newsletter: Fall 2010, Vol.6, No.3

![]() Gotham City Inspector Newsletter

Gotham City Inspector Newsletter

Fall Headlines:

- • Hail to the Sunshine

- • A Closer Reading of Insurance Companies “Denial of Coverage”

- • How to Patch a Torn Window Screen

- • The ARPANET

- • To Our Readers

New York Living

Hail to the Sunshine: Historic Flight

We at Gotham City Inspector are big fans of solar power - what better, cleaner way is there to power our lives and reduce our dependence on fossil fuels than to harness the energy of the sun? So we're delighted to hail recent achievements from the world of solar innovation. The Switzerland-based solar powered airplane, Solar Impulse, is a lightweight plane covered with almost 12,000 silicon mono-crystalline solar cells on its wings and horizontal stabilizer that has made enormous leaps in recent months. In April, the plane took its maiden flight and climbed to just under 4,000 feet and flew for 87 minutes. In July, the plane took its first night flight, remaining in the air for 26 hours. The Solar Impulse's first trans-Atlantic flight is scheduled for 2010 and the ultimate goal is to launch a zero-emissions flight around the world. Good luck to the pioneers working on this amazing endeavor!

Property Management

DENIED!

A Closer Reading of Insurance Companies “Denial of Coverage

MANY PROPERTY OWNERS will, at some point, be faced with having to report a claim to their insurance companies for losses they believe are covered under their policies. Over the years, insurance companies have made this process more and more confusing. This has partially been in response to an increase in fraudulent claims; however, insurance companies seem to have gone too far in trying to dissuade property owners from following through with claims. Many companies writing insurance policies in New York State have resorted to hardball tactics during the investigation process of claims. There are a large number of claims that should ordinarily be paid, but insurance companies will sometimes identify insignificant issues designed to delay their expeditious processing. More often than not, the insurance company will deny a disputed claim, sending the policyholder a denial-letter that specifies the reasons for the denial - and it is that denial-letter that may be grounds for contention.

AFTER AN INSURED party reports a loss, the insurance carrier is contractually obligated to investigate it. Let's consider, for example, a case in which Mr. Smith owns a parcel of property in New York with a building insured for $500,000. Smith was in contract to sell the property, and in anticipation of the closing, he moved his business out of the building on September 1st. The premises were unoccupied until October 15th.

ON OCTOBER 15TH, a fire broke out in the premises causing a total loss to the building. It is undisputed that Smith's insurance company insured the premises on the date of loss and provides coverage for a loss caused by fire. Smith's documents and insurance policy were destroyed in the fire. Smith gets sidetracked with a number of issues resulting from the fire and, in early November, verifies that his policy offers coverage at $500,000.

SMITH NOTIFIES HIS insurance company on November 16th that the premises suffered a fire loss; this is one day past than the 30-day requirement to notify an insurance company of a loss as stated in Smith's policy. The insurance company assigns an adjuster to investigate the loss and determine whether or not it was covered under the policy. During the company's investigation, the fire department determines that the location of the fire ignition was in the boiler room, but is unable to determine whether the boiler malfunctioned or whether the storage of toxic flammable liquids in close proximity to the heating system caused the ignition. Smith's policy contains a prohibition against the storage of these types of toxic flammable liquids on the property. The insurance company hastily issues a denial-letter to Smith, advising that he is not covered for the loss due to his negligence and violation of the prohibition. The denial-letter does not specify any other grounds for denial of the claim and/or coverage.

SMITH FILES A lawsuit against the insurance company seeking compensation for the damages that he sustained in the fire, which he believes are covered by the policy. In the nearly two months between when the insurance company issues the denial-letter and Smith filing the complaint against the insurance company, the insurance company learns that Smith's building was unoccupied for more than 30 days. Smith's policy contained a requirement that the building not be unoccupied for more than 30 days, which Smith inadvertently violated.

WHEN THE INSURANCE company's attorneys answer Smith's complaint, they assert affirmative defenses concerning the storage of flammable and combustible liquids consistent with what was stated in the denial-letter. The insurance company's attorneys also assert affirmative defenses not enumerated in the denial-letter asserting late notice of claim, since Smith failed to notify the company within 30 days, as well as violation of the occupancy requirement as set forth in the policy. The question here is whether or not the insurance company's assertion of additional affirmative defenses are supported by New York law.

THE SHORT ANSWER IS NO. Insuance companies may not assert additional grounds for denying a claim in a subsequent lawsuit that weren't stated in their original denial- letter. Asserting late notice and the occupancy requirement in the lawsuit when the denial-letter only mentioned storage of toxic liquids as the basis of the denial is a violation of New York State law. The denial-letter serves as the insurance company's reason for not covering the loss. Equally important, the denialletter provides written notice to the policyholder of the insurance company's position with respect to the claim and coverage. The insurance company is duty bound to assert all of their reasons in order to properly notify the insured.

THE LAW IN New York is clear in holding that where an insurance company denies coverage and fails to raise certain or specific grounds for the denial in a denial-letter; the insurance company cannot later assert other grounds that were not declared in the original denial-letter in a subsequent lawsuit. However, it should be understood that some insurance claims have a three year statute of limitation. Filing a claim against the insurance company must be done expeditiously on the grounds they did not declare the specific, suitable or proper grounds for denial in their first denial-letter.

Jeffrey A. Sunshine is a partner at the law firm of Jeffrey A. Sunshine, P.C. in Lake Success, N.Y., specializing in business transactions, corporate law, real estate law, real estate litigation, commercial litigation, tort litigation and insurance litigation.

Recipes for Home Repair

Easy Fix-It: How to Patch a Torn Window Screen

If you have screen windows or doors, it's only a matter of time before a section sprouts an unsightly hole. Here's a timeand money-saving way to fix it.

Ingredients

- Household shears or scissors.

- Section of screening 36″ by 24″ inches

- From new screening, cut an even square or rectangular piece two inches larger in width and length than damaged area.

- Create a frayed edge in this piece by removing wire strands ½″ all around (Figure A).

- Bend this frayed edge all around, making sure all edges are bent in the same direction (Figure B).

- From the unused section of new screening, pull one 36″ length of wire to be used as sewing thread.

- Making close, tight stitches, sew on patch over damaged area (Figure C).

Find more home repair tutorials in the free online guide:

Recipes for Home Repair

Did You Know

The ARPANET

The prototype for the current Internet was created in part by the United States military. Called ARPANET, it was conceived in the early 1960's by computer scientists at the Department of Defense in conjunction with university researchers.

The initial ARPANET had four processors installed at the University of California, Los Angeles; Stanford Research Institute; the University of California, Santa Barbara, and the University of Utah. The first message transmitted over ARPANET was sent by UCLA student Charley Kline on October 29, 1969 at 10:30 p.m. to the Stanford computer. The message was: login.

Find diagrams and maps of the ARPAnet at the Computer History Museum:

www.computerhistory.org

To Our Readers

Hello and welcome to the latest issue of Gotham City Inspector! We hope you had a lovely, relaxing summer and are gearing up for a great fall.

One of the inherent risks in being a property owner, whether you are a real estate investor or a home owner, is that accidents can happen on your property. Visitors or residents can be hurt by malfunctioning architectural or construction elements. Water pipes can burst and cause a flood. Fires can ignite and spread quickly. It's for these reasons that property owners are required to carry insurance, and although the best property owner intents keep their property in tip-top shape and in accordance with all building codes and standards, it helps to sleep at night knowing that your insurance policy will cover anything that might happen beyond that. But will it?

As GCI guest contributor Jeffrey Sunshine writes in this issue, many insurance companies have been resorting to hardball tactics during the investigation process of claims. A large number of claims that should ordinarily be paid are instead being denied by the companies based on insignificant issues. Sunshine addresses one such issue here - the “denial of claim” letter, and clarifies on what basis an insurer may deny the claim based on what's in the letter versus other violations it may find after the letter is issued.

Also in this issue is a handy tip for fixing your own window screens, which may have popped a hole during heavy use over the summer. There's also an update on one of our pet obsessions – solar power! From all of us at the Gotham City Inspector, thanks for your support.

Jennifer S. Bleyer, Editor-in-chief

“Helpful ideas at your finger tips!”

If you would like to receive the The Gotham City Inspector© newsletter, please email

your request and include your name, business name, business telephone and address.

E-mail: info@accuratebuilding.nyc

Copyright Ubell Enterprises, Inc. 2007 ©

Accurate Building Inspectors provides home inspection services throughout New York, NYC, Bronx, Brooklyn, Harlem, Long Island, Queens, Staten Island & New Jersey (NJ)